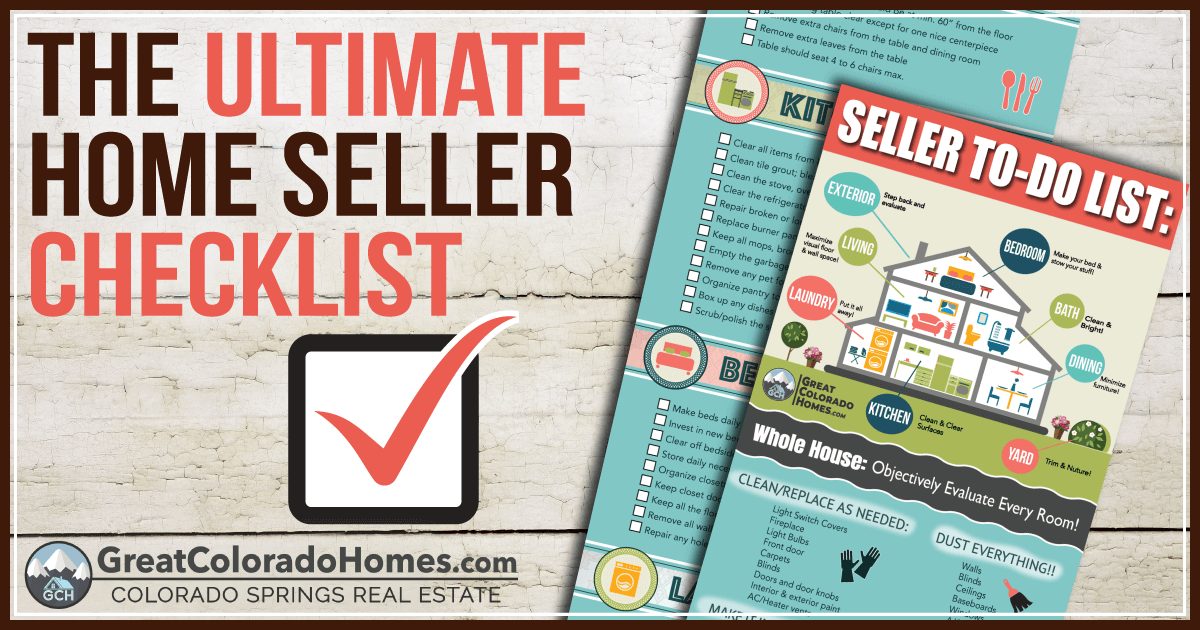

Declutter, Depersonalize and Deep Clean

Buyers want to envision themselves living in the space, so begin by removing personal items like family photos, knick-knacks and excess furniture to create an airy, open environment. Be sure to clean carpets, wash windows, scrub bathrooms and polish hardwood floors. Fix any leaky faucets, cracked tiles or chipped paint so the beauty of your home shines through.

Hire a Real Estate Agent

While you could sell your home on your own, working with a real estate agent can significantly ease your stress while simplifying the process. You should choose a professional with a proven track record – someone who understands the market and is well-versed in selling properties like yours. You might want to interview a few agents to find one who appreciates your needs, communicates regularly and has experience in your neighborhood.

Set the Right Price

Pricing your residence correctly is one of the most important aspects of selling. If you ask too much, you might scare off buyers; too little, and you risk leaving money on the table. Your agent will pull a list of comparable homes in your area to determine a competitive price that creates buzz and attracts the largest possible pool of buyers.

Market for Maximum Exposure

The vast majority of motivated buyers are searching online, so it’s crucial that your property appears across high-traffic websites and social media platforms. Your agent will arrange for quality photography and video to be used in both digital and print advertising, ensuring a positive impression and drawing potential buyers in. Open houses are another great way to generate wide-scale interest for a quick sale.

Negotiate Offers

Once offers start coming in, your agent will help you thoroughly review them. You want to consider the full terms of each offer, not just the price, and be prepared to counter-offer. Some buyers may ask for contingencies, such as credit for upgrades or repairs. Weigh these requests thoughtfully, as they may delay the sale. If an offer needs some adjusting, a skilled agent can navigate you through the process and find a mutually agreeable solution.

Prepare for Closing

Once you’ve accepted an offer, the buyer will likely schedule an inspection and appraisal. If any issues are revealed, your agent may have to renegotiate the terms and price. As these details are being ironed out, you can focus on putting your moving plan in place. Consider the timing of the closing date to ensure a smooth transition.

Seal the Deal

On closing day, you’ll meet with the buyer, the buyer’s agent and possibly the title company to finalize all terms. You’ll sign the final documents, and the buyer will transfer the funds. Once the paperwork is complete, the property officially changes ownership, and you can hand over the keys!

If you’re ready to list, you can start by contacting an agent to learn more about the market activity in your specific location. Selling your home is a big undertaking, but with a mapped-out strategy and expert guidance, you can achieve a successful, financially beneficial outcome.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link